Frequently Asked Questions

What are the basic questions to ask the Financial Aid Office?What are the total costs I will need to cover as a student at SMU?

- How does this package of aid you have offered me cover those costs?

- How much will I need to borrow, and with what types of loans?

- What lenders do you recommend, and why?

- Do you have any financial relationship with the lenders you recommend?

What applications do I need to complete to apply for financial aid?

All students must complete the Free Application for Federal Student Aid (FAFSA) each year to determine their eligibility for federal and state financial aid (found at www.fafsa.ed.gov). Undergraduate students who also want to be considered for university need-based aid must complete the CSS/Financial Aid PROFILE® found at http://student.collegeboard.org/css-financial-aid-profile. There is a $25 cost for completing the CSS/PROFILE®.

What is SMU's school code?

The FAFSA school code is 003613 The CSS/PROFILE® code is 6660.

Can you make too much money to qualify for financial aid?

Although some students may not qualify for need-based aid in the form of grants, most students qualify to receive non-need based federal loans.

Do I have to re-apply for financial aid each year?

Yes, all students must re-apply by renewing their FAFSA each year. Undergraduate students must also renew their CSS/PROFILE® application each year in order to be considered for university need-based aid.

When is the deadline to apply for financial aid?

The priority deadline for first-year undergraduate students is February 15th each year. SMU has a priority deadline of April 15 for continuing undergraduate students so that financial aid advisors can award as much aid as possible after spring grades post in May. An undergraduate student who applies after the priority deadline may not receive primary consideration since certain financial aid funds can be limited. Graduate and professional students may file any time during the academic year; there is no priority deadline. However, SMU recommends filing the FAFSA no later than May 1st in order to secure funding before the start of the term.

My parents don't claim me on their taxes, and I support myself. Can I claim myself as independent and only use my information on the FAFSA?

No. Most students who cannot answer "Yes" to at least one of the thirteen (13) dependency questions on the FAFSA must still include their parents' information.

My parents are divorced. Whose information do I use on the FAFSA?

In most situations, you should use the custodial parent's information (and step-parent if s/he has remarried). This is the parent with whom you live the most and receive the most financial support.

What if I move off campus?

After the second year a student is allowed to live off campus. SMU finds the expenses for living off campus less than living on campus. Please review the off campus budget listed on the costs page because your aid will be reduced accordingly. If a student needs more funds to cover their off campus housing expenses, please contact your financial aid advisor.

Do I have to live on campus?

All 1st year students are required to live on campus or with parents. On rare occasions, students may apply for approval to live off campus with other relatives. To inquire about this exception go to residential life. Please review the cost page for allowances for living off campus, your aid will be decreased to account for the decreased budget for housing.

How do I accept and decline my awards once they’ve been awarded?

Click here for instructions.

Why would my financial aid package change if I change my housing arrangements?

In order to determine how much a student may receive in financial aid, schools must first determine how much it will cost you to go to school. The “Total Cost of Attendance”, often referred to as the COA, is the starting point for all financial aid awards. It includes Tuition/Fees, Housing/Dining, an allowance for books/supplies, an allowance for transportation expenses, and an allowance for personal/miscellaneous expenses, all of which are combined to establish the total COA. Any change to one of the individual COA components will change the total COA

The COA serves as the maximum limit a student may receive in financial aid. The combined total of all financial aid programs cannot exceed the COA. Therefore, a change in housing will change the COA which, as a result, changes the amount you may receive in financial aid.

Although, living on-campus housing provides many benefits, the costs for living on-campus are considerably higher than the cost of living at home. Therefore, a change in housing from on-campus to living at home could result in a reduction in financial aid need based eligibility.

What financial aid awards may change?

Any need-based financial aid may change including federal, state and University need-based awards. For our institutional aid you may incur a reduction in the SMU Opportunity Award in your financial aid package.

What is the SMU Opportunity Award?

This is an SMU need-based grant that is awarded after all scholarships, federal and state grants have been added to your financial aid package and is based on your demonstrated need that is not met by any and all other scholarships or grants.

Will a change in housing impact my academic or talent-based scholarship be impacted?

No, a change in your housing arrangements will not impact scholarships.

Will I have to pay more to the University?

It depends on the change. Every student’s financial situation is unique. If changing from on-campus to living at home, most student owe much less. We recommend that you contact your financial aid advisor to see what the full impact will be for you. Contact information for your financial aid advisor can be found here.

I have or will apply to live at home in the fall but return to on campus housing for the spring. What happens to my aid?

When you return to on campus living your educational costs will reflect the cost of living on campus. Your spring aid would be reviewed and adjusted accordingly.

I have or will apply to live at home for the entire year. What happens to my aid?

If you apply to live at home for the year, then you would petition through Residence Life. If you receive an exemption from living on campus, your educational costs would be changed to reflect living at home and your financial aid adjusted accordingly.

I have or will apply to live at home through DASS for a COVID-19 related exemption. What happens to my aid?

Depending upon where you will be living after your exemption is approved, your educational costs and aid will be adjusted to reflect your housing choice.

I have or will apply to live at home and will attend remotely for the academic year. What happens to my aid?

If your petition to live at home is approved, your educational costs would be adjusted to reflect the living at home arrangement and your financial aid would be adjusted accordingly.

I have been approved for the above, can I change my mind?

You should immediately contact Residence Life if you decide you would like to return to campus. If you are able to make this change, you should then contact your Financial Aid Advisor to make the changes to your educational costs and awards to reflect living on campus.

Why was I selected for verification?

The Department of Education often selects files at random for verification. Schools are required to verify the accuracy of the information reported on the FAFSA.

My parents have filed an extension. What do I do now?

Contact your financial aid advisor to discuss your situation so we may best advise you how to proceed until verification may be completed.

I (or my parents) have filed an extension with the IRS. What do I need to send to SMU?

Please submit IRS Form 4868 along with all your prior year W2s and Form 1099s. If you were self-employed, provide this same documentation and write your estimated AGI and taxes paid for the prior year on the verification form.

My tax information includes a Rollover from Untaxed Pensions or IRA Distributions (lines 15a, 15b, 16a, or 16b on Form 1040; 11a, 11b, 12a, or 12b on Form 1040A). How do I report this to SMU?

If you transferred your tax data using the IRS Data Retrieval Tool on your FAFSA, and then removed the Rollover amounts, please contact your financial aid advisor and provide supporting documentation (e.g., an account statement) for this change.

If you sent an IRS Tax Return Transcript, you would still provide this supporting documentation to SMU. Be sure to indicate the student’s name and ID number when sending this information.

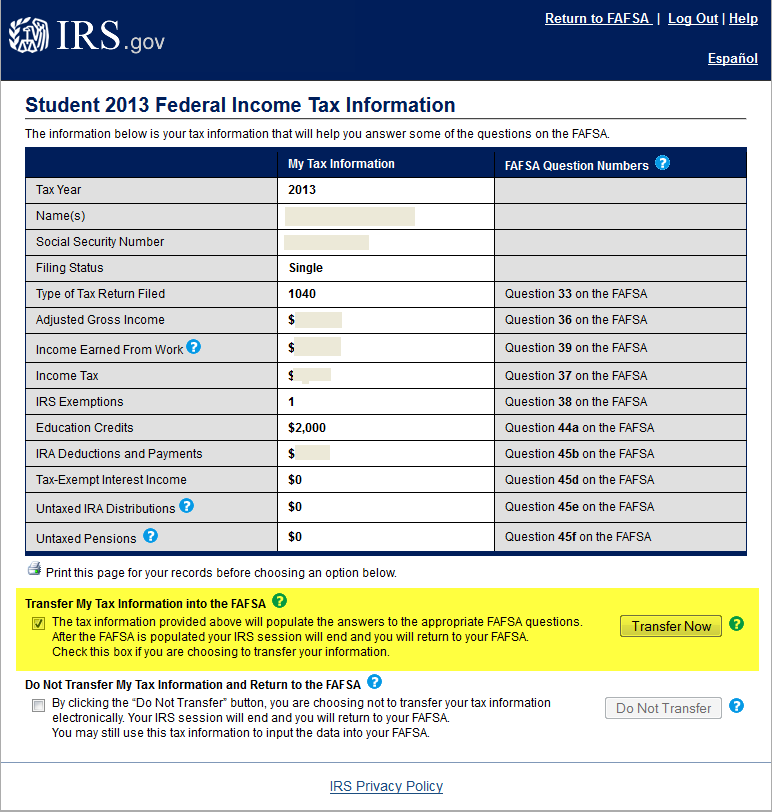

I thought I used the IRS Data Retrieval Tool, but no new FAFSA record has been sent to SMU. What happened?

Often times, a user will transfer their tax data into their FAFSA, but forget to proceed all the way to the end of the application to the Sign & Submit page. Log back into FAFSA.gov and see if this is the case. If so, proceed to this page, enter your and your parents’ PIN numbers, click “Agree” to the Terms of Agreement, and click “Submit my FAFSA now” button.

Another common scenario is that a user clicks the “Link to IRS” button to use the Data Retrieval Tool, is redirected to the IRS site, but does not click on “Transfer My Tax Information into the FAFSA.” If this is the case, log back and complete these steps to successfully transfer your data.

How do I apply for a Pell grant?

You are automatically considered for this federal need-based grant when you complete the FAFSA.

Are graduate students eligible for grants?

Although graduate students are not eligible for federal grants like the Pell grant, they may be eligible to receive the state Tuition Equalization Grant (TEG).

While university scholarships awarded during the admissions process are set, students are encouraged to apply for outside scholarships through websites like www.fastweb.com and www.collegeboard.com.

Are funds from Federal Work Study credited to my account?

No, students must work a Federal Work Study job in order to receive a bi-weekly paycheck. Students are able to use these paychecks as they see fit.

Will SMU help me find a job?

The Hegi Family Career Center maintains a database of Federal Work Study and non federal work study campus jobs. We encourage the student to directly contact the hiring department. The Student Employment Office offers support to students and employers.

What is a "Federal PLUS Estimate" on my award package?

This Parent PLUS estimate usually represents the maximum amount of funds your parent may borrow in one academic year to help pay university costs. The Financial Aid Office should be contacted to confirm the amount of a PLUS Loan.

I accepted the PLUS estimate. Why haven't these funds been posted to my student account?

After you accept this at my.SMU, you will receive an email with detailed instructions for your parent. A parent must then apply for the loan through the Department of Education at studentloans.gov in order to seek credit approval. The Department of Education and SMU will facilitate the process of obtaining the funds after all requirements have been met. More information regarding PLUS loans may be found at PLUS Loan Information.

What is a "Federal GradPLUS loan"?

If this is the first time you have borrowed a Federal Direct Stafford loan at SMU, you will receive detailed instructions on completing the two-step process at studentloans.gov. This process includes Entrance Counseling and completion of the Master Promissory Note (MPN). Both steps must be completed before the loan will disburse to the student's SMU tuition account.

I accepted the Federal Direct Loan, but it has not been posted to my student account yet.

If this is the first time you have borrowed a Federal Direct Stafford loan at SMU, you will receive detailed instructions on completing the two-step process at studentloans.gov. This process includes Entrance Counseling and completion of the Master Promissory Note (MPN). Both steps must be completed before the loan will disburse to the student's SMU tuition account.

Does SMU provide a list of lenders from which to choose private educational loans?

Like numerous institutions across the country, SMU provides students and families a list of lenders to assist them in navigating the complexities of borrowing a private educational loan, however a borrower can choose any lender not on SMU's lender list.

Can students and parents use other lenders?

Yes, SMU allows students and their families to choose their own lender even if not on our list of lenders. SMU encourages all students to investigate a lender before choosing them.

What kind of research should I do regarding choosing a lender?

You should compare repayment benefits and discounts with different lenders you are reviewing including finding out if the repayment benefits are still applicable if the lender sells your loan to another servicer or lender. Some other things you can ask are what percentages of borrowers actually end up qualifying for the repayment benefits; what timeframe their customer service is available; if interest rates are fixed or variable; if interest rates are reduced for on-time payments or auto debit; and when repayment starts and if interest accrues between disbursement and repayment.

How does SMU pick lenders for the lists?

SMU sends an extensive survey to loan companies interested in processing private loans for students of the university. The survey is used to rate lenders for inclusion on one or more of the preferred lender lists. The university seeks lenders who offer the best customer service, secure electronic processes, repayment benefits, lowest origination points, and other benefits. You may contact the loan administrator at enrol_serv@smu.edu for further information on lender list selection. SMU does not receive any payments, benefits or perks from lenders for consideration of inclusion on the SMU lender lists.

- Where do I view my bill?

Student and miscellaneous accounts can be viewed online at SMUPay, which is found through the "Financial Account" panel located on the My.SMU Student Homepage.

- My bill doesn't look correct. What should I do?

You should contact Student Financial Services at 214-768-3417 or via email at enrol_serv@mail.smu.edu and speak with a Student Account Specialist regarding specific bill or account related questions.

- How much does it cost to attend SMU?

Tuition and fee charges may be found on the Bursar website.

- What happens to my financial aid if I drop a class?

As long as undergraduate students remain enrolled in 12-18 hours, they are still considered full-time; therefore, their financial aid will not be affected. However, students who drop below 12 hours should check with their financial aid advisor regarding any possible changes to their financial aid package.

- Must I be full-time to receive financial aid?

If an undergraduate student is receiving federal and institutional need based aid, 12 hours is considered full time. However, SMU encourages all undergraduate students to enroll and complete 15 hours each semester so that they may graduate in 4 years (8 semesters). Sometimes completing 15 hours per semester may not be sufficient to graduate in 4 years, so students should consider attending summer school for 1-2 terms.

- How many terms may I receive financial aid?

Typically, institutional scholarships and need based aid are awarded for 8 semesters only to those who began SMU as first-year undergraduate students; students who enrolled as transfers usually receive institutional scholarships and need based aid for 5 semesters only.

Most financial aid related questions can be answered by our trained Enrollment Resources staff either over the phone or by coming to our service counter. However, we understand that there may be times when you need to speak with a designated financial aid advisor regarding circumstances that are unique to you. Our advisors are available to assist students and families by phone, by appointment or if you just happen to be in the building and want to drop by. We're here to help. All advisors may be reached via email at enrol_serv@smu.edu, by phone at 214-768-3417, or in person by appointment or walk-in. Just check in through our service desk located on the first floor of the Blanton Student Services Building.